Steps To Remove Hypothecation From RC After Car Loan Closure

Primarily, there are two ways you can remove the hypothecation from your RC after car loan closure. You can either take the conventional way of doing it in person at the RTO, or you can do it online. Let's take a look at each of these ways:

RTO Hypothecation Removal Process Offline

- Step 1: Collect the required documents from the lender/bank

- Step 2: Once you have collected all the required documents, you need to visit the RTO office in your jurisdiction

- Step 3: Once you are at the RTO office, you need to apply for hypothecation removal

- Step 4: The application form is available at the RTO office, or you can download it from the RTO website

- Step 4: Once you have submitted the application and paid the fee, the RTO will issue a new RC smart card without the hypothecation details. The process usually takes a few weeks

Here are some additional things to keep in mind:

- You cannot sell or transfer the vehicle until the hypothecation is removed from the RC

- If you are selling the vehicle, the buyer will need to ensure that the hypothecation is removed from the RC before they can take ownership of the vehicle

- If you are planning to export the vehicle, you will need to remove the hypothecation from the RC before you can export it

RTO Hypothecation Removal Process Online

Step 1:

Collect the required documents

Step 2:

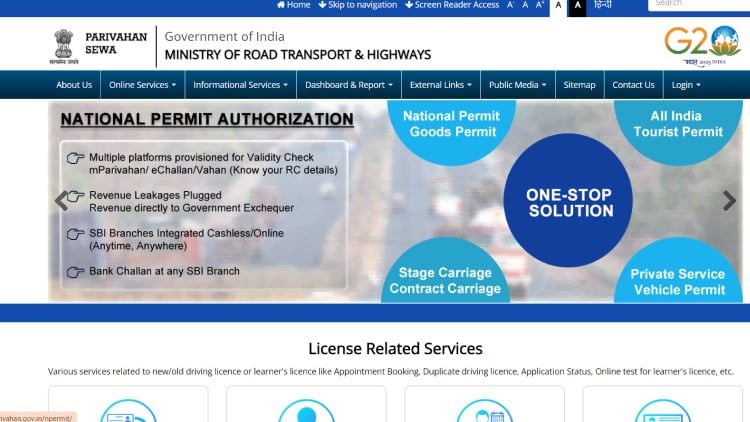

The next step is to visit the Parivahan Seva website. This is the official website of the Ministry of Road Transport and Highways, Government of India

Step 3:

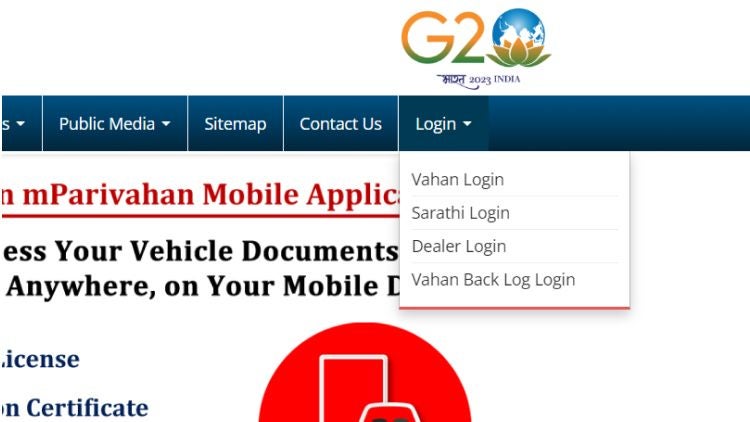

- If you have an existing account on the Parivahan Seva website, you can log in using your username and password. If you do not have an account, you will need to create one

Step 4:

Once you are logged in, you need to select the "Hypothecation Removal" service. This service will allow you to remove the hypothecation from your RC online

Step 5:

Now you need to upload the scanned copies of the required documents

Step 6:

Pay the fee. There is a nominal fee for removing hypothecation from RC online. The fee varies from state to state. You can pay the fee using a credit card, debit card, or net banking

Step 7:

Once you have uploaded the required documents and paid the fee, you need to visit your local RTO to submit the application and complete the hypothecation termination process. The application will be processed within a few days

Step 8:

Once the application is processed, the RTO will issue a new RC smart card without the hypothecation details. The new RC smart card will be sent to your address by post

Here are some additional things to keep in mind:

- You will need to have a valid email address and mobile number to apply for hypothecation removal online

- You will need to scan all the documents properly

- The process of removing hypothecation from RC online may take a few days, so you need to be a little patient

Forms Required to Remove Hypothecation

Primarily three different forms are required for the RTO hypothecation removal process. Let's take a look at these forms and what they are important:

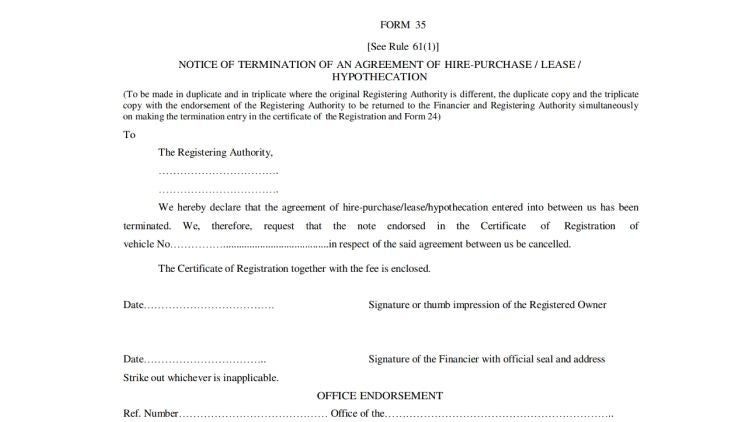

Form 35

- This is an application form used by the vehicle owner to notify the RTO of the termination of a hire-purchase, lease, or hypothecation agreement

- This form is used when the vehicle owner has fully paid off the loan and wants to remove the lender's lien from the vehicle's registration certificate

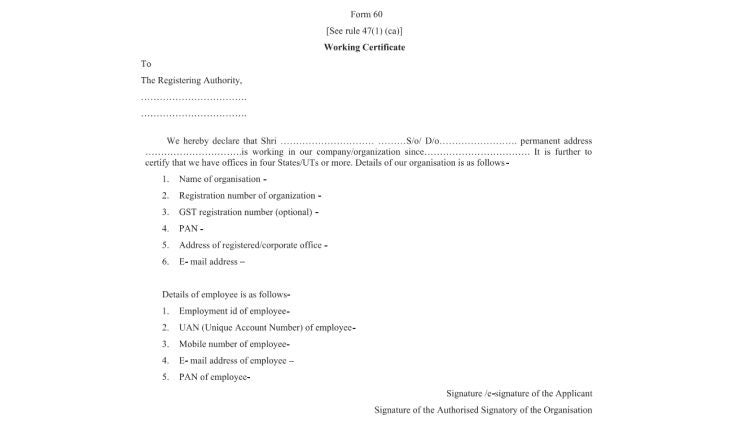

Form 60

- This is a form used by the vehicle's financer to acknowledge that the loan has been fully paid off and to consent to the removal of their lien from the vehicle's registration certificate

- This form is typically submitted along with Form 35

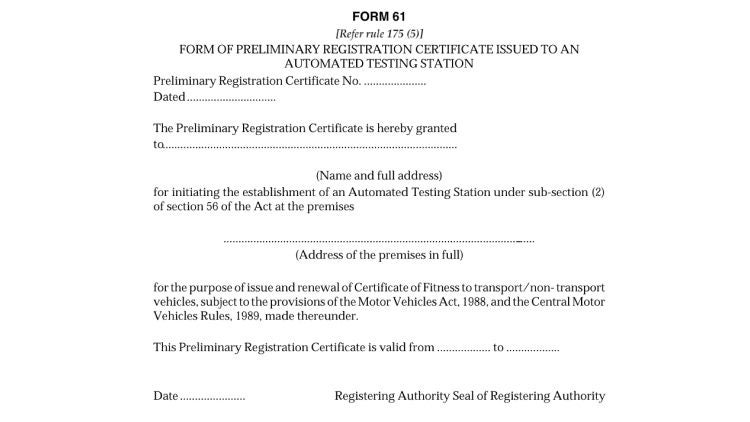

Form 61

- This is a form used by the RTO to endorse the vehicle's registration certificate to remove the lender's lien

- This form is issued to the vehicle owner after the RTO has processed the hypothecation removal application and verified the completeness of the documentation provided

Documents Needed to Remove Hypothecation

Here are all the documents that you need for a seamless hypothecation removal experience:

- Application in Form 35

- Registration Certificate (RC)

- Allotment letter of the vehicle

- Valid insurance certificate

- Proof of address*

- Pollution Under Control (PUC) certificate*

- R.C.Book*

- Attested copy of PAN card or Form 60 and Form 61 (as applicable) *

- No Objection Certificate from financier*

- Chassis & Engine Pencil Print*

- Signature Identification of owner*

Please note that the documents marked with an asterisk (*) are not always mandatory but may be required in some states. It is advisable to get a confirmation from your local RTO office to avoid last-minute hassles.

Once the auto loan is settled, the lender will provide the necessary documents, including the NOC. It's important to note that the NOC is only valid for three months from the date of issue. Therefore, it is advisable to initiate the application process with the RTO before the NOC expires.

Processing Time for Hypothecation Termination

The processing time for hypothecation termination or hypothecation removal typically takes about 2 to 3 weeks in India. Please note that this timeframe may vary slightly depending on the specific RTO office, the volume of applications, and the efficiency of processing procedures.

There are some factors that can impact the processing time. Let's take a look at them: